us exit tax rules

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. In some cases you can be taxed up to 30 of your total net worth.

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Tax Analysts consistently and promptly publishes all relevant developments regarding exit tax including information on.

. By Michael Curzon 0000 Tue May 31 2022 UPDATED. 1 day agoROYAL MAIL has been accused of charging a hefty Brexit tax on items Britons already own. Exit tax is not charged out of mean-spiritedness or as a final grab at your personal assets.

Legal Permanent Residents is complex. The defining feature is that assets are treated as if they are sold on the day before citizenship or resident status is terminated. However in any of the following circumstances the taxpayer may defer the payment of the exit tax subject to interest in line with the provisions of the Income Tax Management Act ITMA by paying it in instalments over five years.

The general proposition is that when a US. What is the US. Became at birth a citizen of the US.

It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. Citizenship or long-term residency triggers both the exit tax and the inheritance tax. But the rules are not limited to.

Exceptions from the exit tax apply to dual nationals from birth who have not lived in the United States for more than 10 years of the last 15 and persons younger than 18-and-a-half who have not lived in the United States for more than 10 years. 0003 Tue May 31 2022. Expats working overseas so it could be helpful to work with a qualified.

Would not have been considered a resident of the US. While there is no overall US. Citizenship or decide to give up your Green Card you need to tie up loose ends with the IRS by ensuring youre all paid up on your US.

Citizens and long-term residents must carefully plan for any proposed expatriation from the US. Tax exclusions and credits are just two examples of the many unique tax rules applicable to US. Citizen renounces citizenship and relinquishes their US.

Green Card Exit Tax 8 Years Tax Implications at Surrender. Exit taxes are relevant because some taxable income such as capital gains on home. When you renounce your US.

THE UNITED STATES EXIT TAX 5 a. For some that means being charged an exit tax on your income in your last year of citizenship or residency. The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as indexed for inflation.

Since 2018 US citizens and US domiciliarieshave been subject to estate and gift taxation at a maximum tax rate of 40 with an exemption amount of 10 million indexed for inflation. Why does exit tax exist. The covered expatriates property for purposes of the exit tax is that property that would be taxable as part of the expatriates gross estate for federal estate tax purposes and is generally valued in the same manner as if he or she had died on the day before the expatriation date as a citizen or resident of the United States Notice 2009-85.

The IRS Green Card Exit Tax 8 Years rules involving US. Expat tax exemption there are exclusions and creditslike the foreign earned income exclusion and foreign tax creditto help alleviate the tax burden for US. The exit tax shall be paid by not later than the companys tax return date in such a manner as may be determined by the Commissioner for Revenue.

Tax may be potentially avoided by limiting income and net worth through gifts. The current form of exit tax deems sold all assets held worldwide by the expatriate. Currently net capital gains can be taxed as high as 238 including the net.

Status they are subject to the expatriation and exit tax rules. Instead exit tax is an attempt by the US government to consolidate your US tax affairs. The exit tax rules impose an income tax on someone who has made his or her exit from the US.

And another country and as of the expatriation date contin-ues to be a citizen of such other country and taxed as a resident of such country. If you are covered then you will trigger the green card exit tax when you renounce your status. Under the substantial presence test of IRC.

Green Card Exit Tax 8 Years. US estate and gift tax rules for resident and nonresident aliens 3. Paying exit tax ensures your taxes are settled when you cease to be a US tax resident.

Nps Exit Withdrawal Rules Relaxation In Processing Of Exit Application By Pops Rules Nps Pension Fund

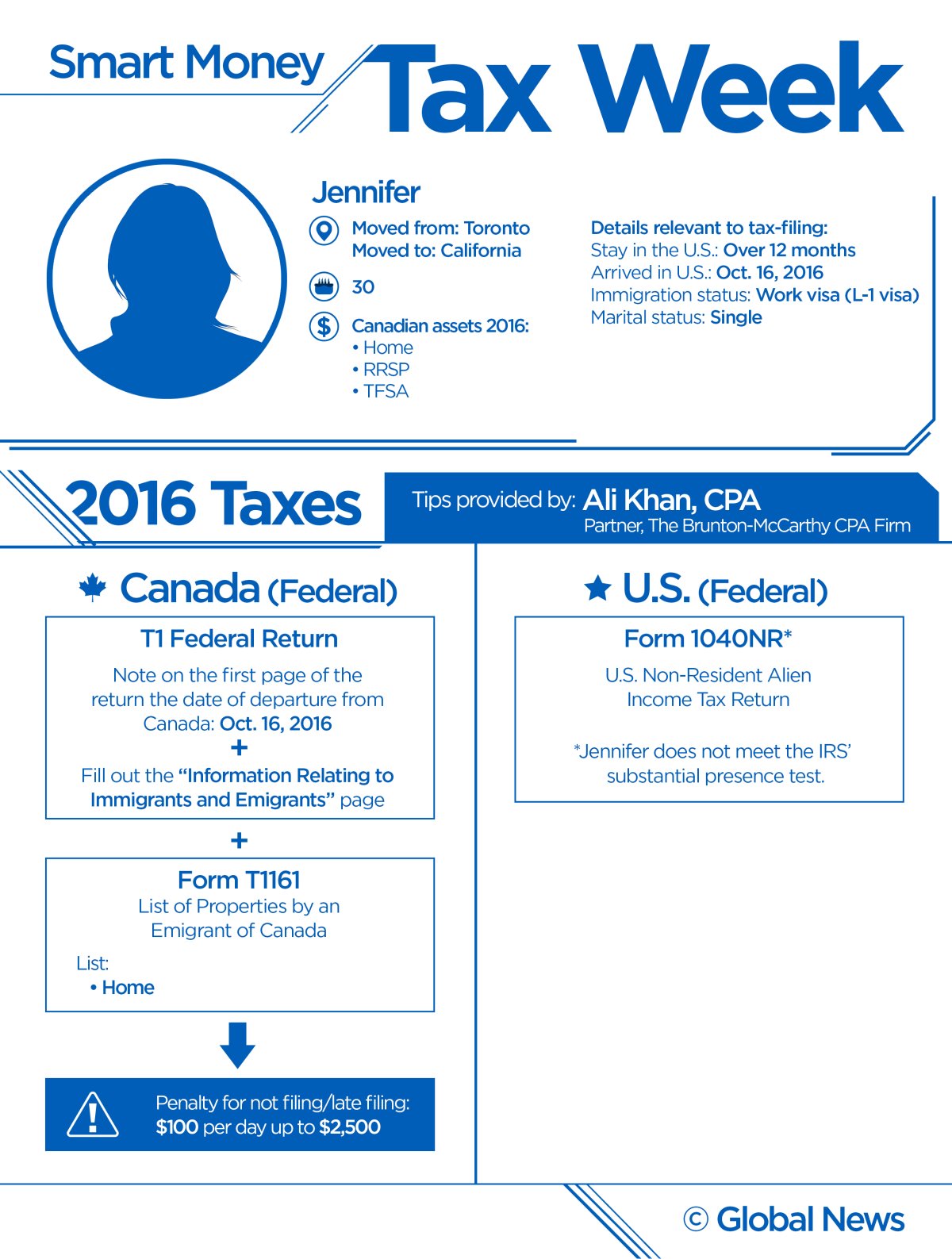

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

What Are The Us Exit Tax Requirements New 2022

Exit Tax In The Us Everything You Need To Know If You Re Moving

Government Announces Issuance Calender For Sovereign Gold Bond For H1 Fy21 Follow Us In Gold Bond Investing Chartered Accountant

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Departure Tax Exit Tax Changed In 2018 Or Maybe Not

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Green Card Exit Tax Abandonment After 8 Years

What Are The Us Exit Tax Requirements New 2022

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax In The Us Everything You Need To Know If You Re Moving

Exit Tax Us After Renouncing Citizenship Americans Overseas

9 States That Don T Have An Income Tax Income Tax Tax Income

Exit Tax Us After Renouncing Citizenship Americans Overseas

Renounce U S Here S How Irs Computes Exit Tax

Could Changes To Canadian Tax Law Prompt Interest In Us Business Visas Visaplace Canadian Us Immigration Lawyers Business Visa Business Prompts